Invest Smart with Ringgit-cost Averaging Strategy

Ringgit Cost Averaging (RCA) is a proven investment strategy that helps you navigate market fluctuations and reduce risks associated with market timing. By consistently investing a fixed amount, you can grow your unit trust portfolio strategically.

We've long felt that the only value of stock forecasters is to make fortune tellers look good. Even now, Charlie and I continue to believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children – Warren Buffett

What is RCA ?

- Long-term investment technique

- Investing a fixed amount of money into a given investment on a regular basis, regardless of the price

- Helps reduce the risk associated with investing a single large sum

- Helps to build your unit trust portfolio strategically over time.

The Benefits of Practising RCA :

How does RCA work ?

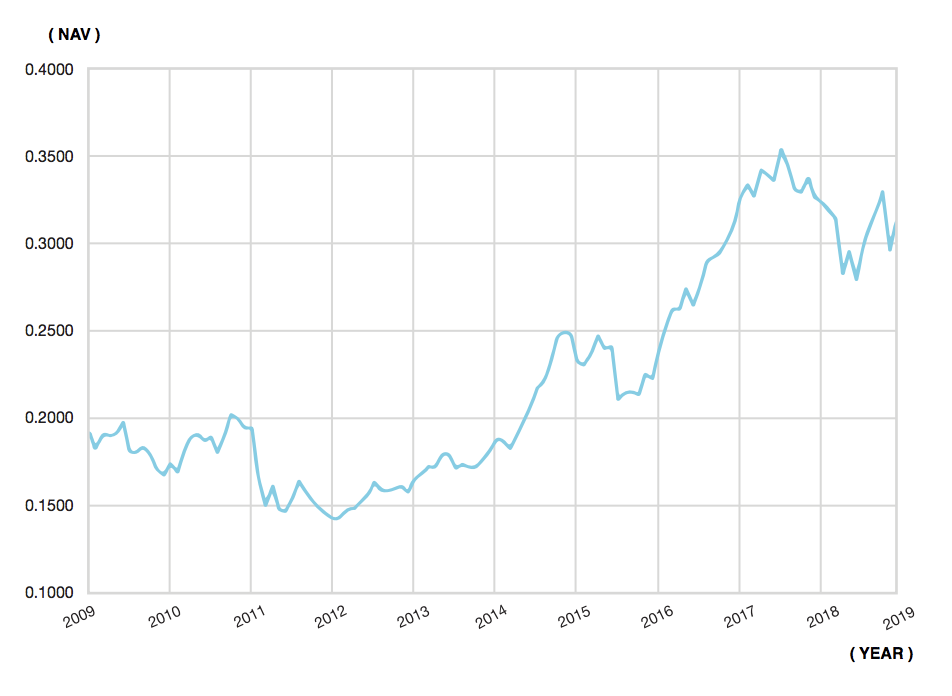

Monthly Investment RM950#

Knowing that it is difficult to predict the market movement, Raymond practises RCA by investing RM950# every month over a period of 10 years. By doing so, Raymond managed to average out the cost per unit held. This is because the RM950# he invested every month purchased more units when prices were low, and less units when prices were high.

- Total investment cost over 10 years: RM114,000

- Total units accumulated over 10 years: 558,990.28*

- Average cost per unit held: RM114,000 / 558,990.28 units = RM0.2039*

# RM950 is net of sales charge.

* Based on the net asset value (NAV) per unit1 of Public China Select Fund for the period from July 2009 to June 2019.

1 Adjusted for distribution of 0.50 sen per unit declared as of 31 July 2018. Source: Lipper

RCA Tips

- Start as soon as possible to build a sizeable account over time.

- Stay invested for the long term regardless of price fluctuations.

- Take advantage of Direct Debit Authorisation (DDA) and Regular Investment Authorisation (RIA) via Public Mutual Online (PMO).

This article is prepared solely for educational and awareness purposes and should not be construed as an offer or a solicitation of an offer to purchase or subscribe to products offered by Public Mutual. No representation or warranty is made by Public Mutual, nor is there acceptance of any responsibility or liability as to the accuracy, completeness or correctness of the information contained herein.