Break the Cycle and Live a Debt-Free Life

Having too much debt can hinder you from achieving your financial goals earlier. Plan how you can pay down your debt faster so that you can start saving and investing for your future.

Debt is a double-edged sword. If debts are managed well, they will improve our lives and help us accomplish our goals, for instance obtaining an education, purchasing a home or expanding our businesses. If they aren’t, they will invite problems into our lives.

1 Section 5, Act 360 Insolvency Act 1967

2 Malaysian Department of Insolvency, Bankruptcy Statistics 2025 (data from 2021 to July 2025)

3 Malaysian Department of Insolvency, Bankruptcy Statistics 2025 (data as at July 2025)

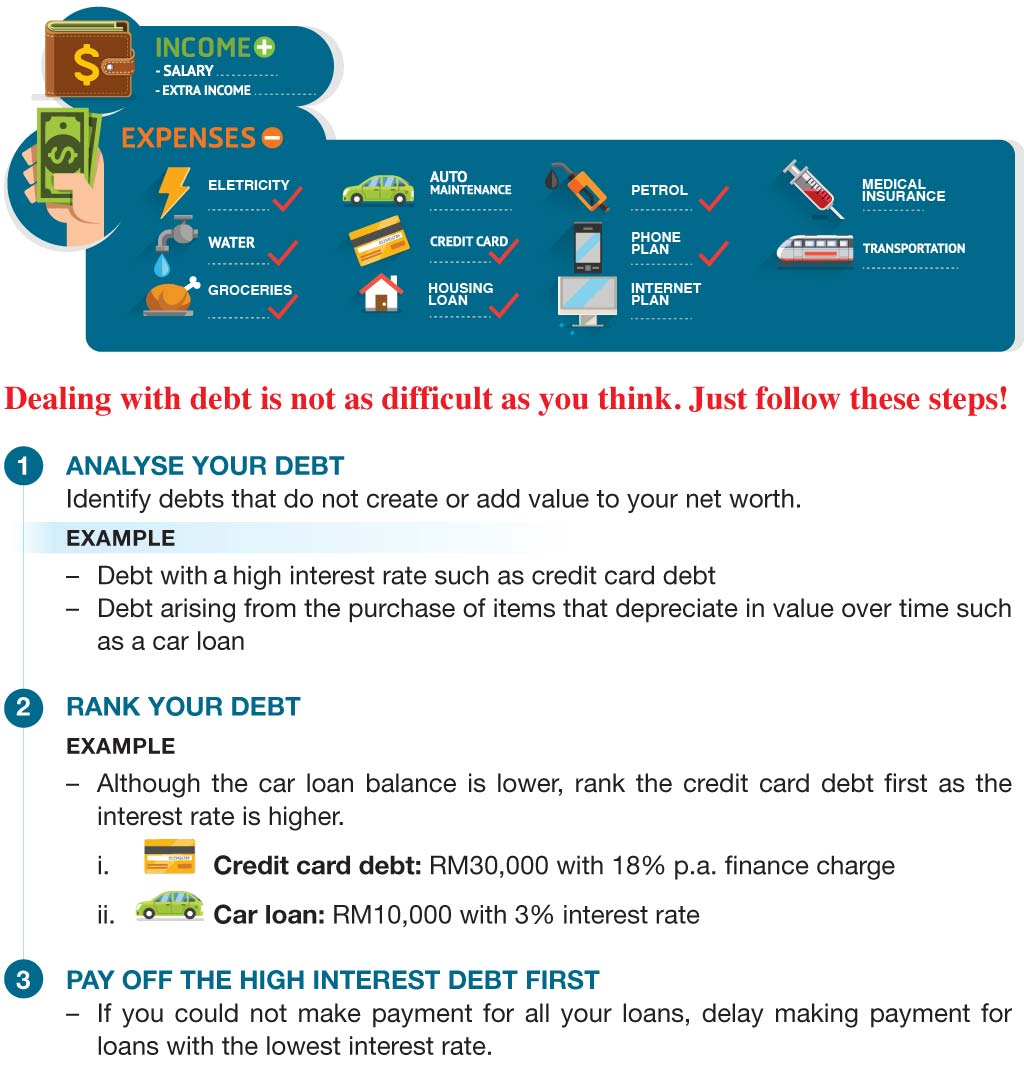

Here are some tips for managing your money effectively to avoid debt:

START PLANNING

- Make a budget and stick to it

- Set realistic financial goals

STAY DISCIPLINED

- Continue repaying the debt

- Track your spending

- Pay off your credit card bill on time every month

- Be a smart buyer and avoid impulsive purchases

START SAVING / INVESTING

- Save to purchase something you really need

- Invest every month to achieve your financial goals

This article is prepared solely for educational and awareness purposes and should not be construed as an offer or a solicitation of an offer to purchase or subscribe to products offered by Public Mutual. No representation or warranty is made by Public Mutual, nor is there acceptance of any responsibility or liability as to the accuracy, completeness or correctness of the information contained herein.