Consistency is Key

The Ringgit Cost Averaging (RCA) strategy allows unit trust investors to focus on their long-term financial goals without worrying about the short-term market movements.

Stock markets are inherently volatile and to determine the best time to enter the market is a near-impossible feat. As renowned author of "The Intelligent Investor‟, Benjamin Graham aptly said, “If I have noticed anything over these 60 years on Wall Street, it is that people do not succeed in forecasting what’s going to happen in the market."

That is why it is important for investors to not time the market. Instead, investors should adopt the Ringgit Cost Averaging (RCA) strategy to build wealth for the long-term.

RCA is a simple strategy of investing a fixed sum of money into a selected unit trust fund over a period of time regardless of the market cycles. By investing a fixed amount on a regular basis, investors can buy more units when the market is down and fewer units when the market is doing better. This will average out the cost of investment over time and mitigate the volatility of stock markets.

In addition, investors who adopt the RCA strategy need not worry about the point of entry into the market. This is in contrast to those who opt to invest a lump sum – they are exposed to the risk of entering the market at or near its peak and subject themselves to unnecessary anxieties and mental stress as they try to pick market bottoms and market tops.

The RCA strategy is also more practical for those who do not have the means to invest a huge lump sum. The popular Malay saying “sikit-sikit lama-lama jadi bukit” aptly describes this strategy that allows investors to invest an affordable sum each month and gradually build their investment portfolio.

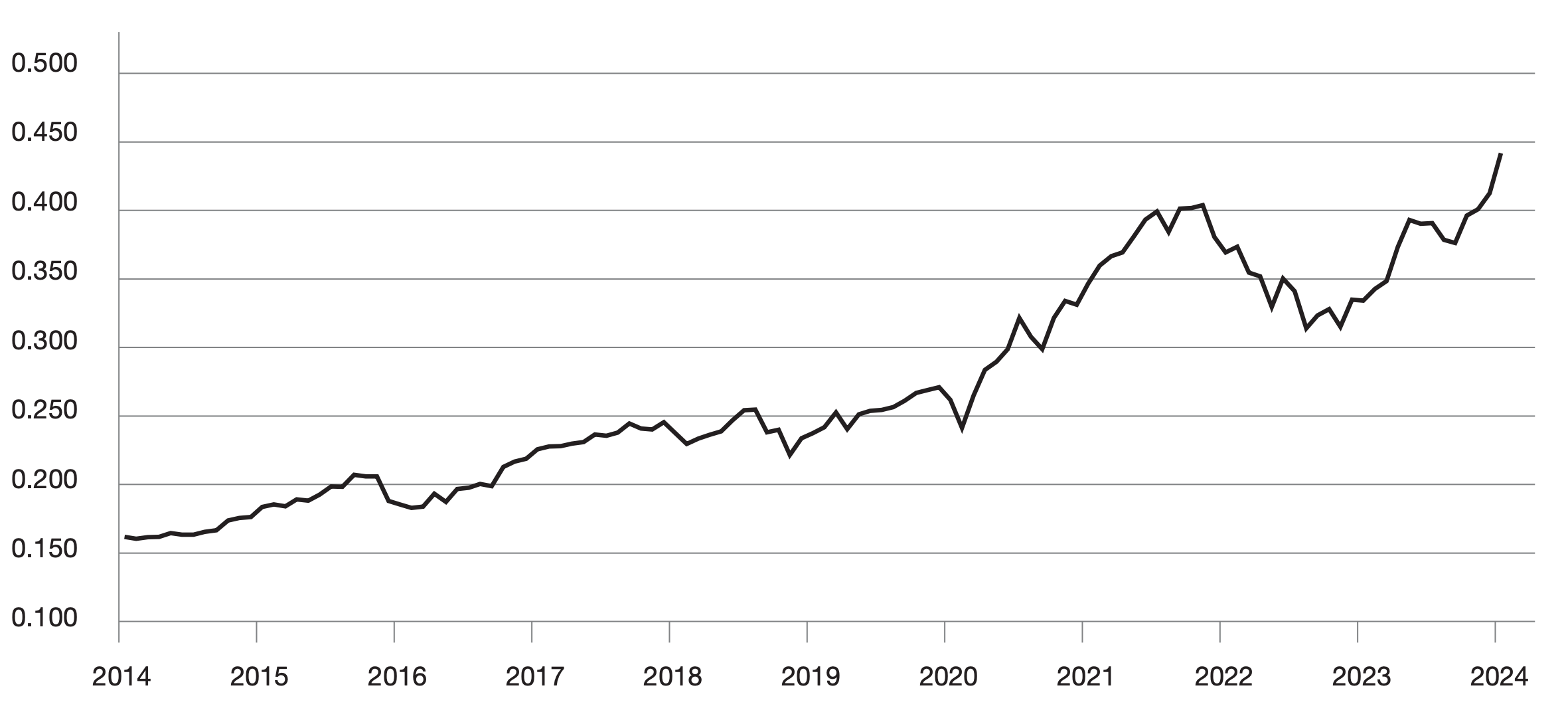

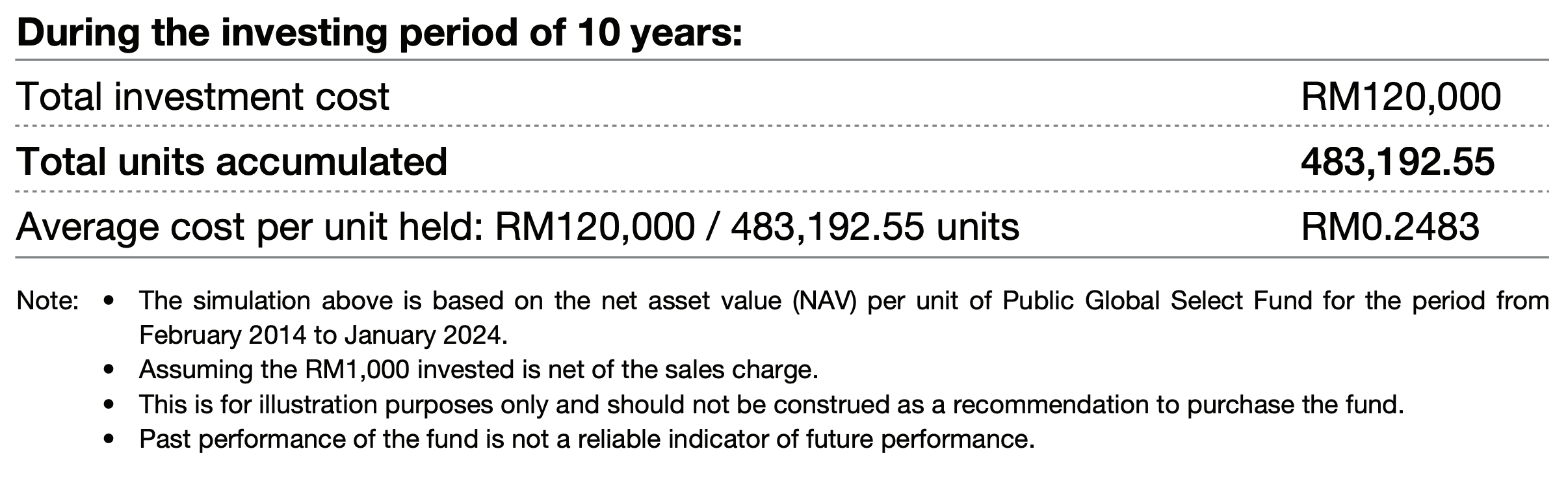

Illustration

Fund X's Net Asset Value (NAV) from 2014 to 2024

Source: Lipper

Mr A started investing with RM1,000 in Fund X and continued to invest the same amount every month for 10 years. By adopting the regular investing strategy, Mr A managed to grow his investment over time. This is because the RM1,000 he invested every month purchased more units when prices were low and less units when prices were higher.

Investors are advised to read and understand the contents of the Master Prospectus 1 of Public Series of Funds dated 28 August 2023 and the relevant fund’s Product Highlights Sheet (PHS) before investing. Investors should understand, compare and consider the risks, fees, charges and costs involved in investing in the fund. A copy of the Prospectus and PHS can be viewed at our website.

Investors should make their own assessment of the merits and risks of the investment. If in doubt, investors should seek professional advice. Fund performance should be evaluated against a benchmark index which is reflective of the fund’s asset allocation and investment over the medium to long term. Past performance of the fund is not a reliable indicator of future performance. Please refer to our website for our investment disclaimer.

How to Get Started?

Investors can incorporate the RCA strategy into their investment through Public Mutual’s Direct Debit Authorisation (DDA).

DDA is an authorisation to the bank of investor’s selection to deduct an amount determined by them to be transferred into the unit trust fund of their choice. For example, they can choose to transfer RM500 on a monthly basis or RM2,000 every quarter. The amount and frequency of investments depend on their financial means and future goals.

Benefits of Adopting DDA

- Convenient

Having your investment contributions automatically deducted on a regular interval is an easy and convenient method of saving for future. - Affordable

Investing in Public Mutual via DDA starts from as low as RM100 monthly. - Consistent

DDA ensures consistent investment. This is a great way to inculcate good savings habit for building wealth. - No market timing involved

With DDA, your portfolio will grow steadily without having to time the market.

Building wealth by investing in unit trusts requires patience and persistence, so investors should adopt the RCA strategy to make the most of their investments.

RCA Tips:

- Start as soon as possible to build a sizeable account over time

- Stay invested for the long term regardless of price fluctuations

- Take advantage of DDA

This article is prepared solely for educational and awareness purposes and should not be construed as an offer or a solicitation of an offer to purchase or subscribe to products offered by Public Mutual. No representation or warranty is made by Public Mutual, nor is there acceptance of any responsibility or liability as to the accuracy, completeness or correctness of the information contained herein.