FAQ on ESG Investing

Environmental, Social and Corporate Governance (ESG), or Sustainable and Responsible Investing (SRI) is an investment approach that has grown rapidly over the past decade, especially among institutional and millennial investors. This FAQ discusses the value of good ESG practices and how environmentally and socially-conscious investors can align their personal values with their investments through ESG funds.

“Sustainability is meeting the needs of the present without compromising the ability of future generations to meet their needs.”

- Our Common Future, World Commission on Environment and Development/ Brundtland Commission, 1987

- What is ESG investing?

ESG investing is a values-based investment approach that considers a company's environmental, social and governance (ESG) practices alongside its financial performance.

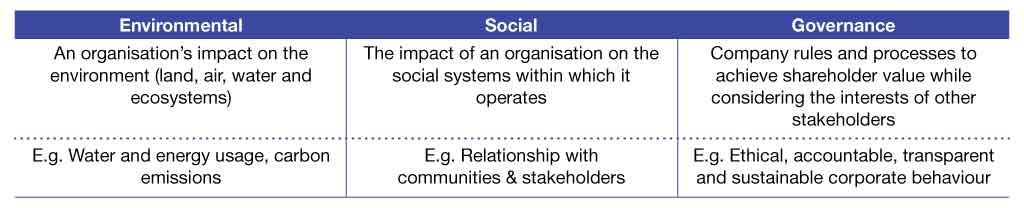

Table 1: ESG Defined

Source: Adapted from Bursa Malaysia’s Sustainability Reporting Guide, 2nd edition (2018) and the Securities Commission’s Malaysian Code on Corporate Governance 2021

ESG investing has gained momentum over the past decade, especially among millennials, who are generally more environmentally and socially-conscious than those of earlier generations. Today, sustainability has become a key focus in a world faced with environmental and social issues such as global warming, climate change and the Covid-19 health pandemic.

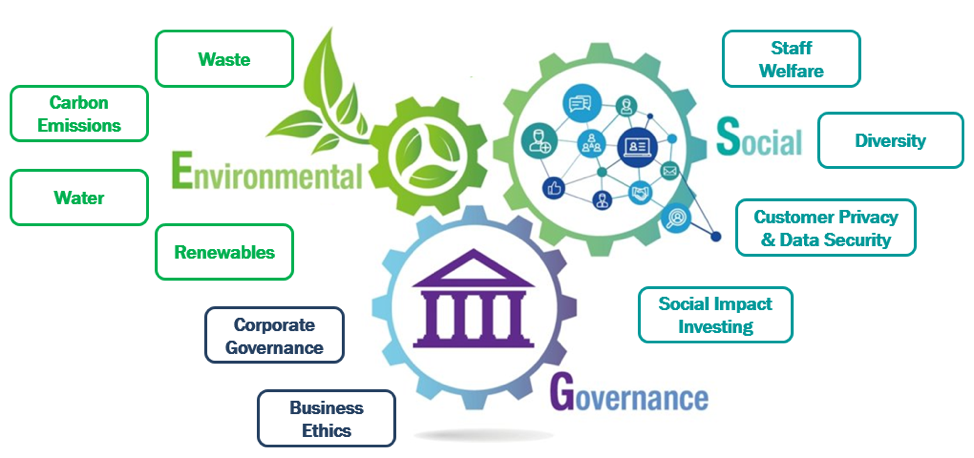

Fig. 1: Examples of ESG Factors

Furthermore, policymakers around the world have been actively pushing the ESG agenda, with regulators encouraging listed companies to adopt more ESG practices.

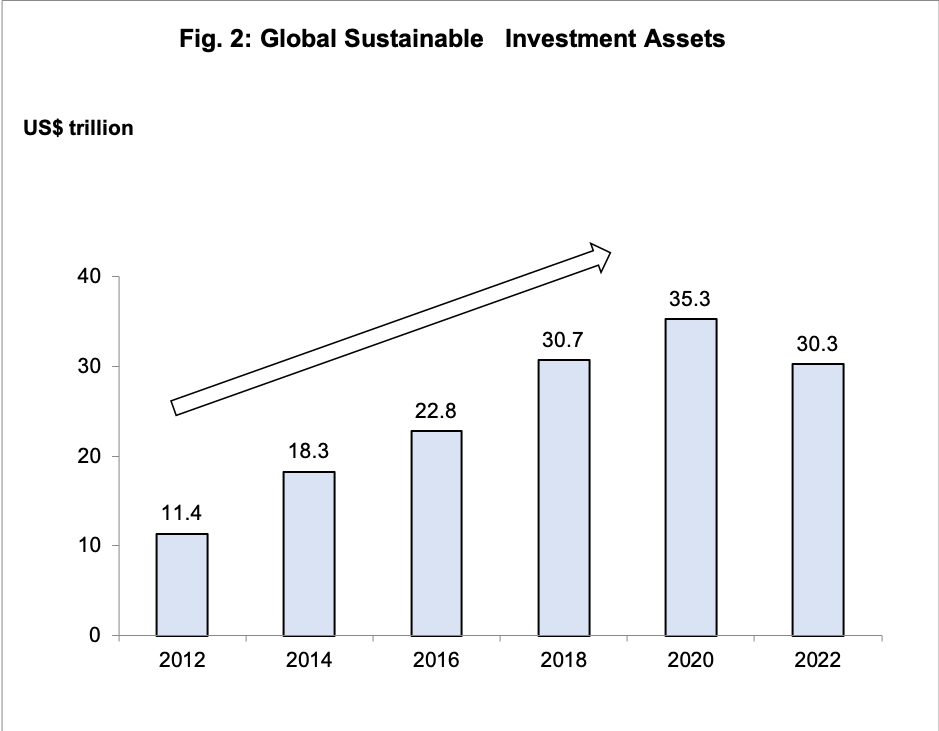

Source: Global Sustainable Investment Review 2022

Globally, the size of sustainable investment assets has risen significantly by 211% over the 2012 to 2020 period (Fig. 2). However, the asset size declined by 14% to US$30.3 trillion in 2022 as the adoption of a more stringent methodology led to a decline in assets labelled as “sustainable” in the U.S.

- Why are good ESG practices important?

ESG practices are important in creating long-term sustainable value for companies and their shareholders. Research studies on ESG investing found that good ESG practices:

- Have a positive impact on companies’ operational performance and;

- Help attract a lower cost of capital, which allows companies to raise funding at lower rates.

As these companies invest in areas such as renewable energy, clean technology and resource efficiency, they gain competitive advantages through improved efficiency and greater innovation. This, in turn, contributes to the companies’ performance and potentially creates added value for their investors.

- How does ESG investing create value for investors?

ESG funds cater to investors who wish to incorporate sustainability considerations into their investment decisions. Not only are these investors interested in the financial outcome of their investments, they are also concerned about the impact of their investments on the environment and the community.

Through ESG investing, investors play an important role in influencing the sustainability practices of the companies they invest in. For example, companies that do not adopt good sustainability practices and are rated poorly in ESG scores may be excluded from the investment universe for ESG funds.

- How can investors position their investments to benefit from ESG investing?

ESG funds allow investors to align their values with their investments. These funds provide an opportunity to diversify portfolios and invest in companies which adopt leading ESG practices in their business operations.

This article is prepared solely for educational and awareness purposes and should not be construed as an offer or a solicitation of an offer to purchase or subscribe to products offered by Public Mutual. No representation or warranty is made by Public Mutual, nor is there acceptance of any responsibility or liability as to the accuracy, completeness or correctness of the information contained herein.