FAQ on Hard and Soft Landing

When the global economy slows, economists would evaluate whether the outcome might be a “hard landing” or a “soft landing”.

These terms are commonly used to describe the pace of an economy’s deceleration from its current growth momentum.

|

This article highlights the differences between a hard and soft landing for an economy and what it means for investors. 1. What is a hard and soft landing? A soft landing occurs when an economy sustains a mild slowdown whereby consumer and investment spending softens, but continues to register positive or flattish growth. In comparison, a hard landing describes a potential recession with a sharp contraction in spending, resulting in many workers losing their jobs and companies significantly reducing their capital investments.

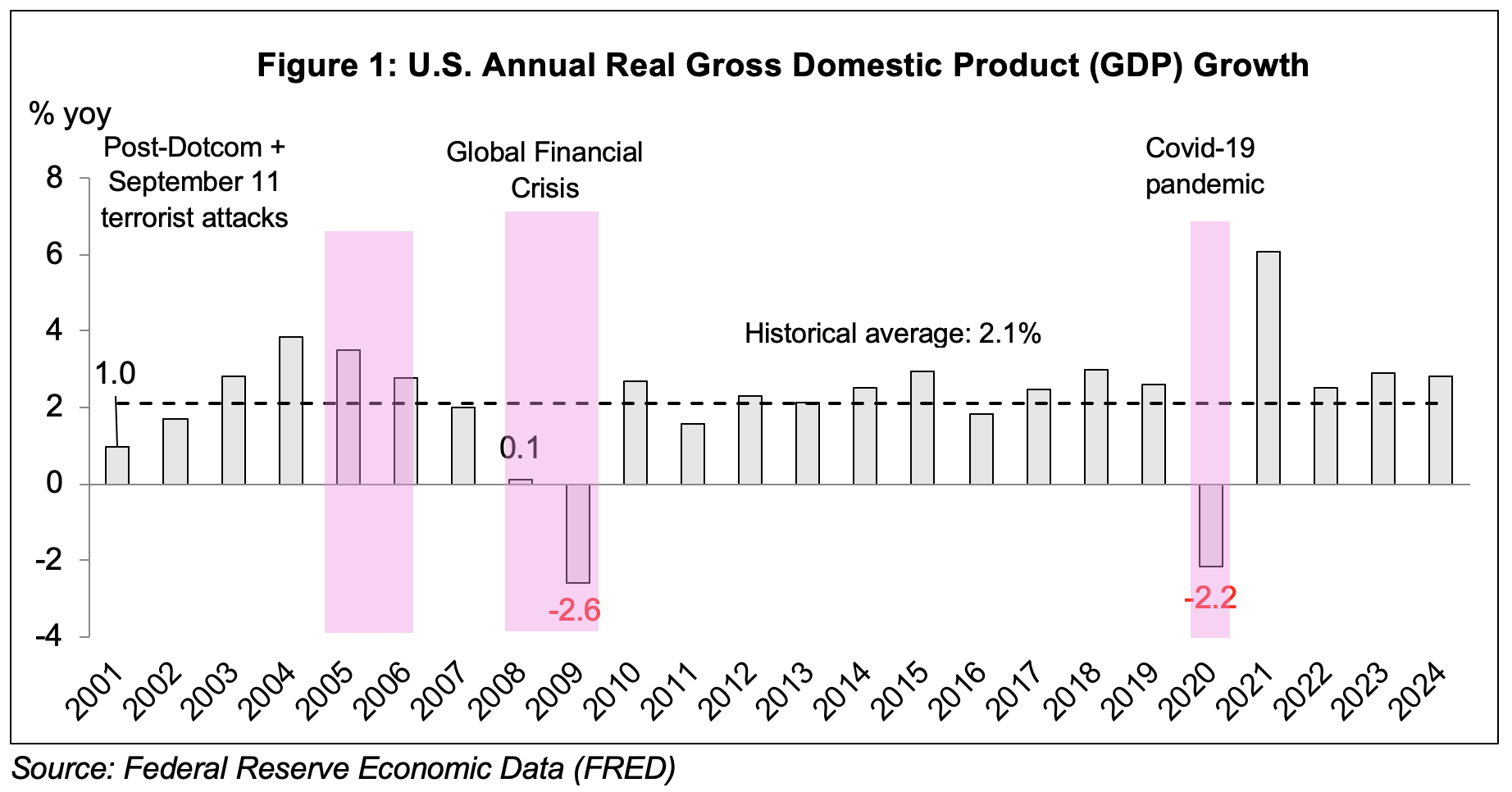

2. Past hard and soft landings for the U.S. economy In the 2000s, the United States’ (U.S.) economy experienced both a soft landing (in 2001 post the dotcom boom and September 11 terrorist attacks) and a hard landing (during the 2008-2009 Global Financial Crisis, or GFC). As the U.S. economy’s growth moderated from 4.1% in 2000 following the dotcom boom to 1.0% in 2001 with most consumers and companies continuing to spend and invest, this economic slowdown was considered a ‘soft landing’.

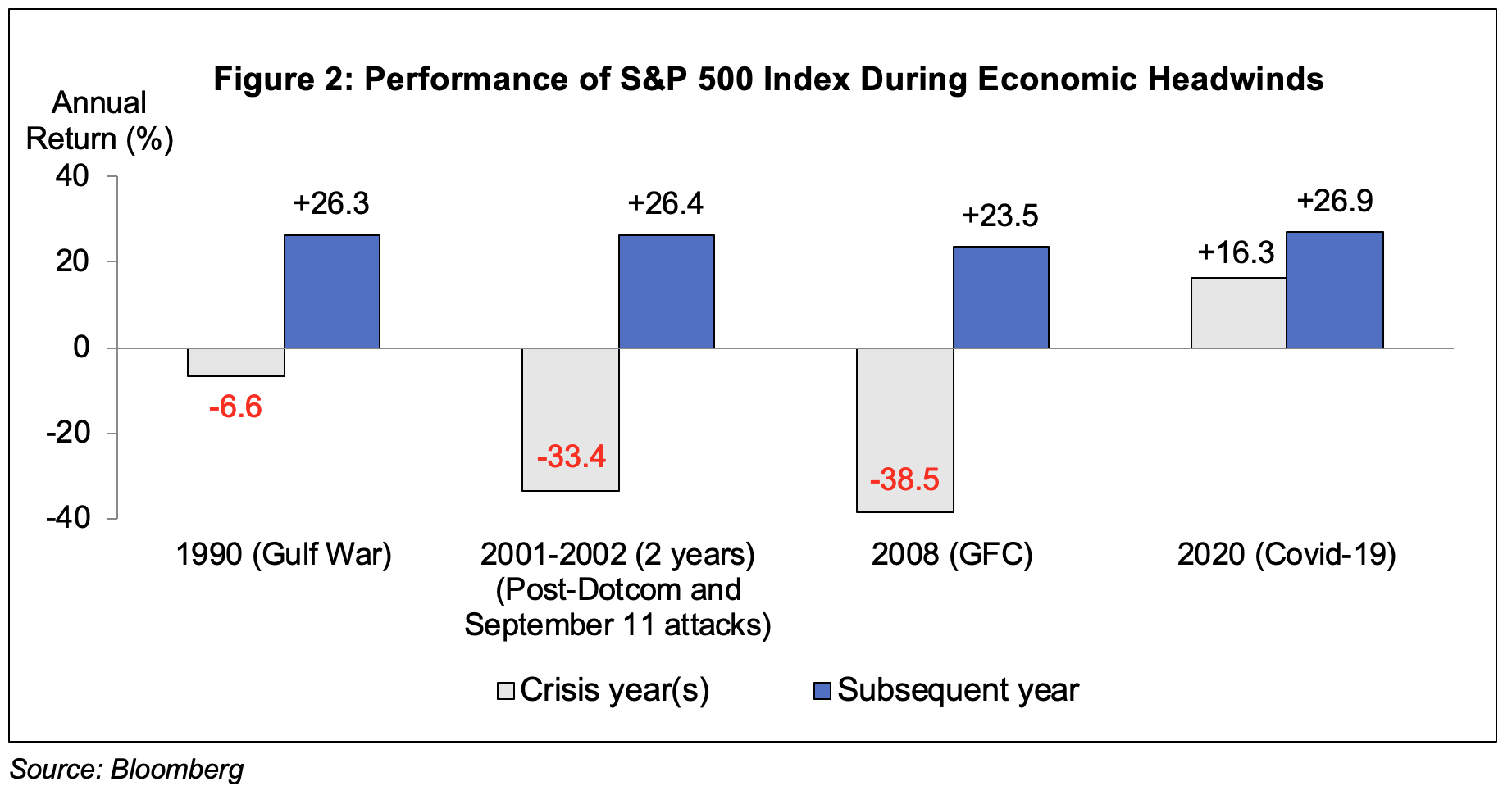

3. How have stock markets performed in past hard and soft landings? Economic conditions play a significant role in influencing corporate earnings, which directly affect share prices. The pace of an economy’s slowdown - whether a hard landing or a soft landing - can therefore differently impact equity market performance. Figure 2 shows the impact of notable instances of decelerating economic growth on the U.S. equity market.

4. What factors could lead to a hard landing for the global economy? There are 3 key risks that could lead to a hard landing for the global economy:

5. What can central banks and governments do in a hard landing? In the event of a hard landing, central banks and governments typically loosen monetary policies (e.g. lower policy interest rates) and implement expansionary fiscal policies (e.g. higher government spending). For example, during the GFC in 2008-2009, the Fed steeply reduced the Fed funds rate (FFR) from 5.25% to a record low of 0.25%.

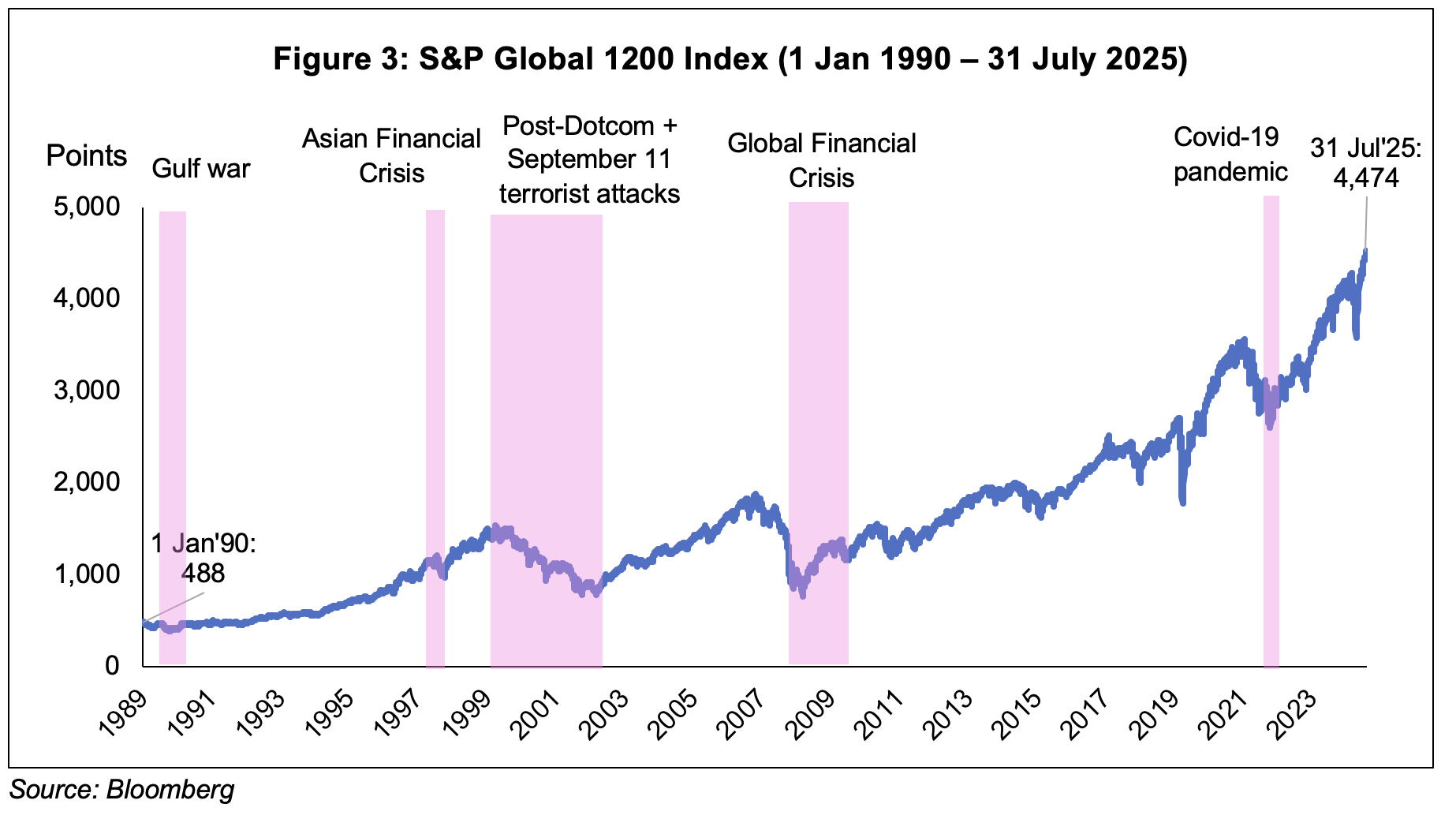

6. Equity investors should stay invested for the long run Whether in a soft or hard landing, equity investors should stay invested throughout the economic cycle. In the last three decades since 1990, despite several economic and financial crises, the global equity markets (as proxied by the S&P Global 1200 Index) have recovered from short-term market setbacks (Figure 3).

Conclusion Expectations for a soft or hard landing for the global economy can affect the equity markets in the near term. Nonetheless, as equity markets tend to reflect the underlying fundamentals of the economies over the long term, investors in equity funds should adopt a long-term investment perspective and to stay invested by practising Ringgit Cost Averaging (RCA) to ride through the economic and market cycles. |

This article is contributed by Public Mutual and is prepared solely for educational and awareness purposes, and should not be construed as an offer or a solicitation of an offer to purchase or subscribe to products offered by Public Mutual. No representation or warranty is made by Public Mutual, nor is there acceptance of any responsibility or liability as to the accuracy, completeness or correctness of the information contained herein.