FAQ on the U.S. Fed Tapering

With the United States (U.S.) economy on track to recover further in 2022, the U.S. central bank is scaling back, or “tapering”, the extensive stimulus it provided during the Covid-19 pandemic.

What is the U.S. Federal Reserve’s (Fed) tapering and how will this impact the financial markets?

1. What is the Fed’s bond-buying programme meant to do?

In times of economic crises, apart from lowering short-term interest rates, central banks may adopt more aggressive monetary measures to encourage spending and investment. For example, the Fed embarked on a major bond-buying programme in March 2020 to mitigate the severity of the recession following the outbreak of Covid-19. This programme consisted of monthly purchases worth US$120 billion in U.S. government bonds and mortgage-backed securities.

For starters, the central bank increases the money supply through the purchase of government bonds as shown in Figure 1. The purchase of bonds by the central bank increases the liquidity in the financial markets and lowers long-term interest rates as the higher purchasing demand results in a decline in bond yields. This encourages businesses and consumers to borrow due to the more attractive interest rates; thereby boosting investment and consumer spending. As a result, the increased spending helps to create jobs and stimulate the economy.

Fig. 1: Economic Impact of Central Bank Bond-Buying

| 1. Creation of money by the central bank | |

| 2. Central bank buys government bonds | |

| 3. Interest rates decline | |

| 4. Businesses and consumers are encouraged to borrow | |

| 5. Businesses and consumers invest and spend, stimulating the economy |

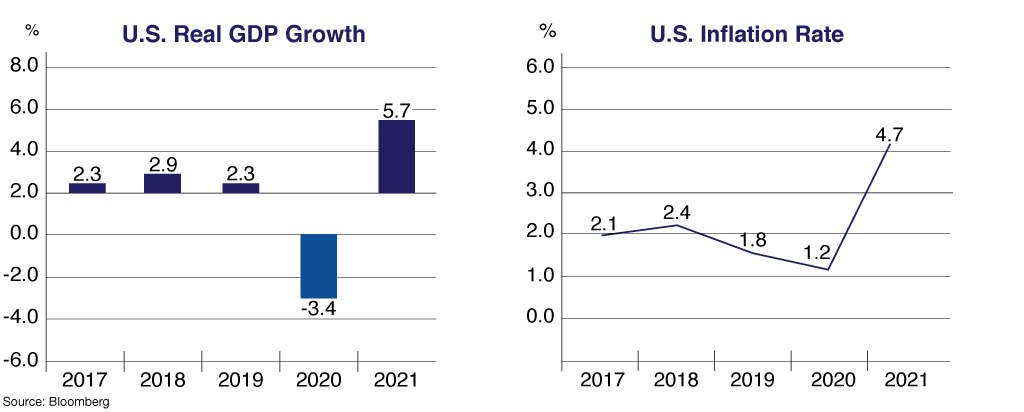

Fig. 2: U.S. Real Gross Domestic Product (GDP) and Inflation

2. Why is the Fed “tapering”?

In simple terms, “tapering” refers to the winding down of the Fed’s monthly bond-buying programme. With the U.S. economy experiencing rising inflationary pressures amid the continuation of its recovery from the pandemic (Fig. 2), the Fed has started to taper with a monthly reduction of US$15 billion in bond purchases in November and December 2021. Effective January 2022, the reduction of the Fed’s bond purchases will be increased to US$30 billion a month. At this rate, the tapering of the Fed’s US$120 billion bond-buying programme is expected to end by March 2022.

Fig. 3: The U.S. Federal Reserve's Tapering in 2014

3. What was the impact on the financial markets when the Fed tapered its bond purchases in 2014?

During the Fed’s last tapering exercise in 2014, its monthly bond purchases of US$85 billion was steadily reduced from January 2014 until October 2014 (Fig. 3).

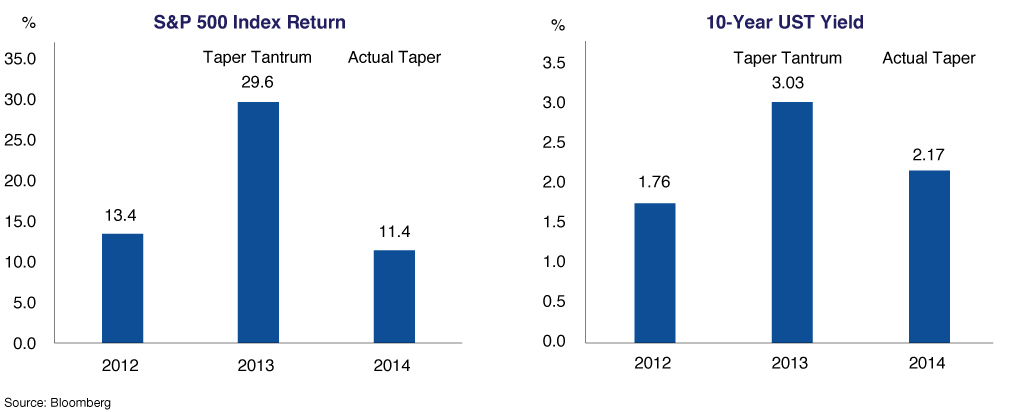

Nonetheless, bond yields did not rise in 2014 as the 10-year U.S. Treasury (UST) bond yield had already risen by 127 basis points (bps) to 3.03% in the preceding year during the “taper tantrum”, which refers to the market reaction towards tapering remarks by the then-Fed Chairman Ben Bernanke. In fact, the 10-year UST bond yield fell by 86 bps to end 2014 at 2.17% as bond prices recovered (Fig. 4).

On the equity front, the U.S. market initially experienced volatility ahead of the taper. Subsequently, positive economic and corporate earnings momentum led the U.S. market to recover, with the S&P 500 Index registering annual gains of 29.6% in 2013 (taper tantrum) and 11.4% in 2014 (actual taper).

Fig. 4: Returns of the S&P 500 Index and Levels of the UST Yield

4. How will the Fed’s current tapering impact financial markets?

Looking ahead, investors anticipate the Fed to start normalising (raising) its policy interest rate - the overnight Federal Funds Rate (FFR) - when the bond tapering ends. The steady recovery of the U.S. economy, along with elevated inflation levels, led the Fed to project at least three policy interest rate hikes for 2022 at its Federal Open Market Committee meeting in December 2021.

Due to tightening liquidity conditions and rising interest rate expectations, the tapering of bond purchases and potential interest rate hikes by the Fed may result in short-term volatility in the currency, bond and equity markets. Nevertheless, the longer-term outlook for the equity markets will depend on the prospects of the underlying economic conditions as well as corporate earnings. As more economic sectors re-open across the world, the growth rates of most economies are expected to recover to their pre-pandemic levels by 2022/2023.

Conclusion

The tapering of the Fed’s asset purchase programme has been well-signalled ahead of the actual event by Fed Chairman Jerome Powell. As other major economies continue to strengthen in 2022, their central banks are also likely to start scaling down their respective monetary stimulus measures which were introduced in response to the global health pandemic in 2020.

While the gradual tightening of monetary policies may result in volatility for global financial markets, the equity markets are anticipated to generally remain supported by expectations for the continued economic recovery as well as the positive outlook for corporate earnings.

As such, unit trust investors are encouraged to maintain a diversified portfolio across geographical markets and asset classes in accordance with their risk profiles. Adopting a long-term investment horizon and making regular investments using Public Mutual’s Direct Debit Authorisation (DDA) and Regular Investment Instruction (RII) facilities would also better position unit trust investors to ride through short-term market volatility.