Helpful Tips for A Successful Unit Trust Investment

Investors are encouraged to follow the following investment must-dos to enjoy successful investing.

You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ. - Warren Buffett

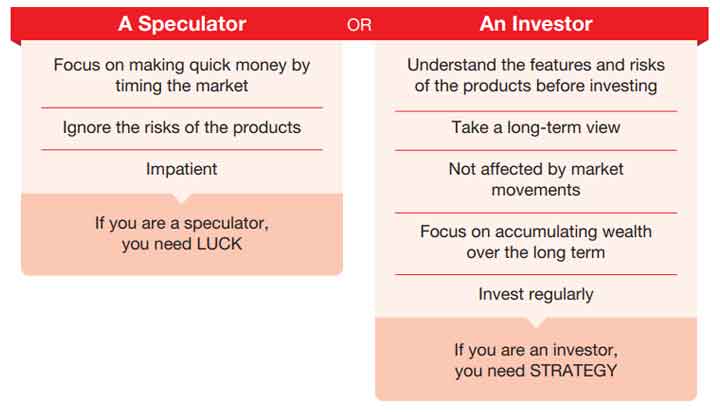

Some say that luck plays a role in investing and several things need to happen for an investor to make money: correct stock pick, market movement and timing.

But is it necessary to be lucky? That depends if you choose to be:

Here are the DO's and DON’Ts in strategising your unit trust investment:

DO's

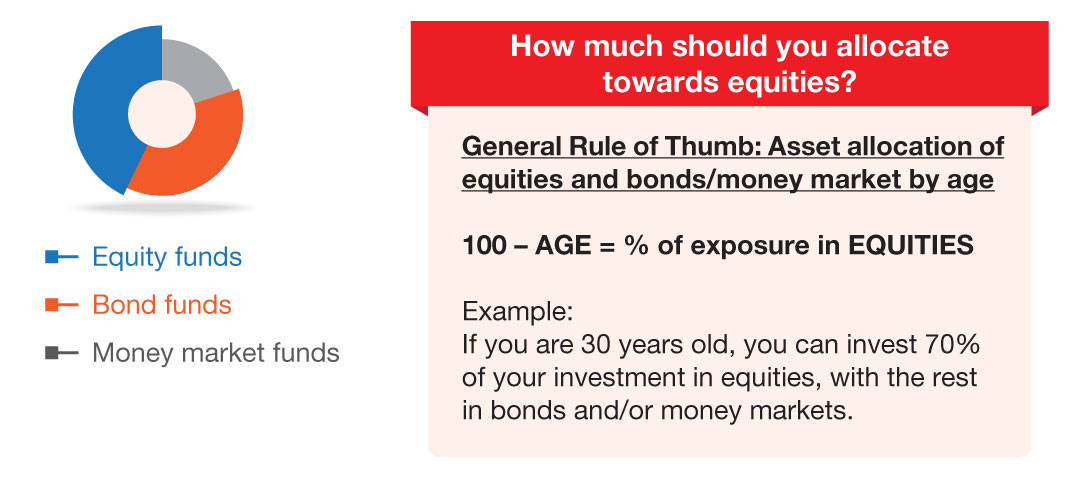

- Asset allocation

Apportion the investment among various asset classes according to an individual’s goals, risk tolerance and investment horizon.

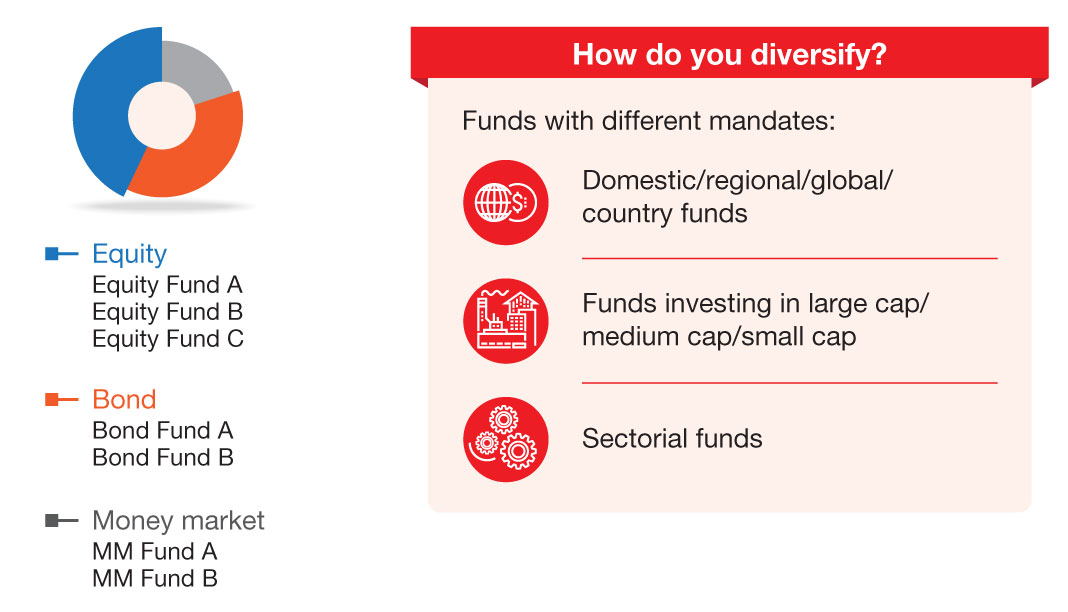

- Diversification

Spread the investment into various funds within each asset class to reduce the portfolio's overall volatility.

- Ringgit Cost Averaging (RCA)

RCA is an investment technique in which investors invest a fixed amount of money on a regular basis. RCA brings you these benefits:

How to apply RCA?

Sign up for Direct Debit Authorisation (DDA) via our online facility, Public Mutual Online (PMO).

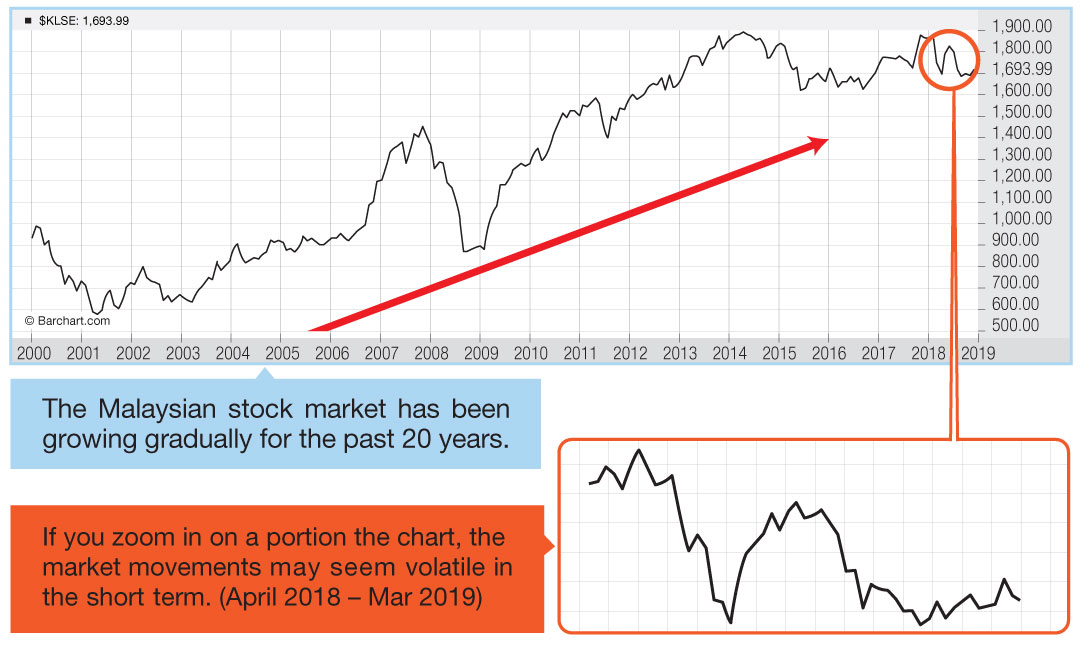

- Invest for the long term

While it may seem volatile in the near term, the stock market tends to reflect the fundamentals of the underlying economy over the long run.

DON’T

- Don’t put all your eggs in one basket

If an investor invests in only a fund or two, and they are from the same fund category (e.g. domestic equity fund only), a potential decline in the performance of that fund(s) will have a substantial impact on the overall portfolio.

- Don’t try to time the market

Timing the market is difficult even for investment Gurus. So investors should not attempt to do so through frequent buying and selling of funds.

- Don’t perform frequent switching

Investors often switch between funds in an attempt to improve their returns. However, frequent and emotional switching may cause negative effects to the portfolio’s returns, not only because there are costs involved, but timing the market is extremely difficult too.

- Don’t make emotional decisions

Fear and greed are often two major emotional drivers in making irrational decisions, where investors engage in frantic buying and selling during the ups and downs of the market cycle.

This article is prepared solely for educational and awareness purposes and should not be construed as an offer or a solicitation of an offer to purchase or subscribe to products offered by Public Mutual. No representation or warranty is made by Public Mutual, nor is there acceptance of any responsibility or liability as to the accuracy, completeness or correctness of the information contained herein.