Staying the Course in the Long Run

Adopting a long-term investment horizon is key to successful unit trust investing. Here’s how you can successfully stay the course.

Like the slow and steady tortoise prevailing over the hare in the race, investors who remain focused on their long-term goals are more likely to achieve their financial objectives

than those who react to near-term market movements and mis-time the markets.

Short-term market fluctuations are unpredictable and often driven by extreme pessimism or irrational exuberance. In view of the volatile nature of the stock markets, investors should focus on riding through market cycles by adopting a long-term investment horizon.

In addition, investors who invest a fixed amount of money on a regular basis can better withstand the impact of market volatility. This strategy is known as Ringgit Cost Averaging (RCA), which allows you to buy more units of an investment when prices are low and fewer units when prices are high. Ultimately, the investor achieves a lower average cost which translates into a higher return when the market recovers.

Capitalising on Market Downturns

Long-term investors can use RCA as a strategy during bear markets or volatile market conditions. By consistently investing a fixed amount of money when markets are sold down, this strategy should enable investors to accumulate shares at undervalued prices.

By viewing market declines as great buying opportunities, you can enhance your long-term return potential when the market eventually rebounds. For example, the U.S. market has historically trended upward over the long run, and investors who invested in U.S. equities when prices were relatively low will generally be rewarded when prices rebound. Thus, investors are advised to practice a disciplined investing strategy such as RCA to capitalise on the volatility in the markets.

Staying Invested May Prove Rewarding Over the Long Term

Although there’s no proven way to predict short-term market movements, some people still try to time the market. They reduce their investments when they think the market is about to decline, and invest more when they think the market is about to rise.

By trying to time the market, you risk missing out on market rallies that could improve your overall returns and long-term wealth. Thus, it is important to stay invested and remain focused on your long-term investment objectives.

Stay Disciplined and Diversified

Over the past few years, investors have seen a number of shocks and disruptions to global financial markets caused by various economic and geopolitical factors. Markets may also react dramatically in response to specific events. Getting – and staying – prepared for difficult times, however, is often a determining factor for long-term success.

Seasoned investors know that in the long run, markets have shown remarkable resilience in times of crisis. For instance, during the Covid-19 pandemic, stock markets fell sharply, with the S&P 500 Index declining by as much as 30.7% during the first quarter of 2020. However, the index subsequently registered a strong rebound from April 2020 onwards to end the year with an annual gain of 16.3%.

Thus, investors who are disciplined, invested for the long run and hold a diversified portfolio of unit trust funds will have a greater degree of confidence that their investment goals would be achieved.

Riding the Bulls and Bears

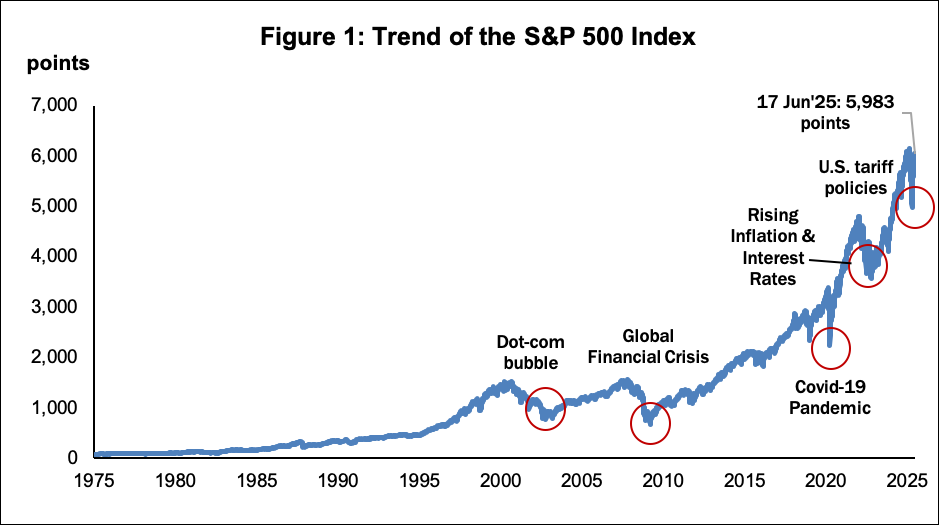

Over the past 50 years, the U.S. stock market has experienced its fair share of ups and downs (Figure 1). Since 1974, the S&P 500 Index, which proxies the U.S. market, has generated positive returns in 38 years (76%) and only 11 years of negative returns (24%).

Out of the years with positive returns, the S&P 500 Index registered double-digit gains in 29 of the 38 years (76%), with gains of up 34.1%. In comparison, the index declined in 11 years over the same period, with losses ranging between 0.7% (2015) and 38.5% (2008).

Source: Bloomberg

Overall, the S&P 500 Index enjoyed annualised returns of 9.3% per annum since 1974 despite temporary market corrections. Over the long term, the U.S. equity market has trended higher, supported by healthy corporate earnings growth and gains in the technology sector on the back of digitalisation trends.

“The best time to invest was yesterday, the second-best time is now,”

said billionaire investor Warren Buffet.

As equity markets are inherently volatile in the short term, investors are encouraged to adopt the four key principles of long-term investing, harnessing market volatility, regular investing / practising RCA, and building a diversified portfolio. This will enable investors to remain disciplined, with a sound strategy to capitalise on the full potential of their investments.

This article was updated by Public Mutual Investment Division in June 2025

This article is prepared solely for educational and awareness purposes and should not be construed as an offer or a solicitation of an offer to purchase or subscribe to products offered by Public Mutual. No representation or warranty is made by Public Mutual, nor is there acceptance of any responsibility or liability as to the accuracy, completeness or correctness of the information contained herein.