The Benefits of Adopting a Long-Term Investment Horizon

Unit trust investors who maintain a long-term investment horizon stand to benefit from higher potential returns over time.

While there are no standard periods defining various investment horizons, a long-term investment horizon of 10 years or more is required for investments to bear fruit.

By choosing to stay invested over the long term, unit trust investors are positioned to get the most out of their funds, in terms of capital gains and the accumulation of reinvested distributions. The benefits of adopting a long-term horizon are:

a) Compounding Returns over Time

Compounding is the process where capital gains or income distributions are reinvested to generate additional returns over time. By holding on to their investments for a longer period, investors will be able to reap the benefits of compounding.

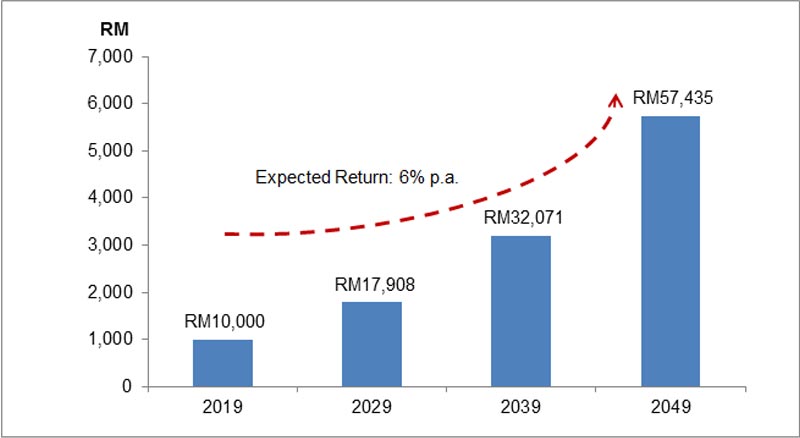

Figure 1: The Value of RM10,000 Compounded at 6.0% p.a. over 30 years

Note: Figure 1 shows how an investment of RM10,000 compounded at an average return of 6.0% per annum (p.a.) can grow to a value of RM57,435 in 30 years’ time.

To enjoy the benefits of compounding returns, it is important to start investing early. The earlier you start investing, the greater the accumulated returns on your original investment. It is not just about how much money you invest, but also how much time you allow your money to grow.

A patient investor is akin to a farmer who waits throughout the seasons for the land to yield its valuable crops. Likewise, financial investments need sufficient time for the prospective rewards to be achieved.

b) Potential for Higher Returns

A portfolio of unit trust funds would benefit from being invested over the long term as the businesses invested in take time to mature. For example, a manufacturing company may take a few years to invest in new capacity and commence production before it can generate the full potential profit from its investments. Hence, investors stand to benefit from potentially higher returns by giving their investments more time to grow.

c) Keeps Investors’ Emotions at Bay

Another benefit of adopting a long-term investment horizon is that it deters investors from making investment choices under the influence of emotions. Investing based on excessive optimism or worry of making losses often leads to poor investment decisions, as investors are more prone to making rash decisions in response to short-term market movements.

Maintaining a long-term investment horizon keeps investors focused on their long-term financial goals rather than attempting to time the market by switching in and out of funds. Ringgit Cost Averaging, which is the strategy of putting a fixed Ringgit amount into unit trust investments at regular, predetermined intervals, on a monthly, quarterly or half-yearly basis, can help to anchor investors’ emotions throughout all stages of the market cycle.

Conclusion

Prominent investor Warren Buffet once said that “Nobody buys a farm based on whether they think it is going to rain next year or not. They buy it because they think it's a good investment over 10 or 20 years”.

Hence, rather than predicting what will happen tomorrow, investors should focus on the long-term prospects of their funds and the markets in which they are invested.

In fact, while equity markets may undergo periods of elevated volatility, they generally provide commendable returns over longer investment periods. Thus, adopting a long-term investment horizon with a well-diversified portfolio of funds is one of the best strategies of letting your money work for you.

This article is prepared solely for educational and awareness purposes and should not be construed as an offer or a solicitation of an offer to purchase or subscribe to products offered by Public Mutual. No representation or warranty is made by Public Mutual, nor is there acceptance of any responsibility or liability as to the accuracy, completeness or correctness of the information contained herein.