Loading

Loading

Grow Your Wealth with Unit Trusts

Public Mutual offers a wide range of unit trust funds to meet various investors' needs.

What is Unit Trust?

- Unit trusts are collective investment schemes that allow investors with similar investment objectives to pool their funds together.

- These funds will be invested by professional fund managers in a portfolio of securities according to the fund’s objective and investment strategy.

Benefits of Investing in Unit Trust Funds

Professionally Managed

Competitive Returns

Effective Diversification to Minimise Risks and Optimise Returns

Ease of Transactions

Flexibility to Invest and Redeem

Regulated by Securities Commission Malaysia

Capitalise on the Power of Compounding

Peace of Mind

Power of Compounding

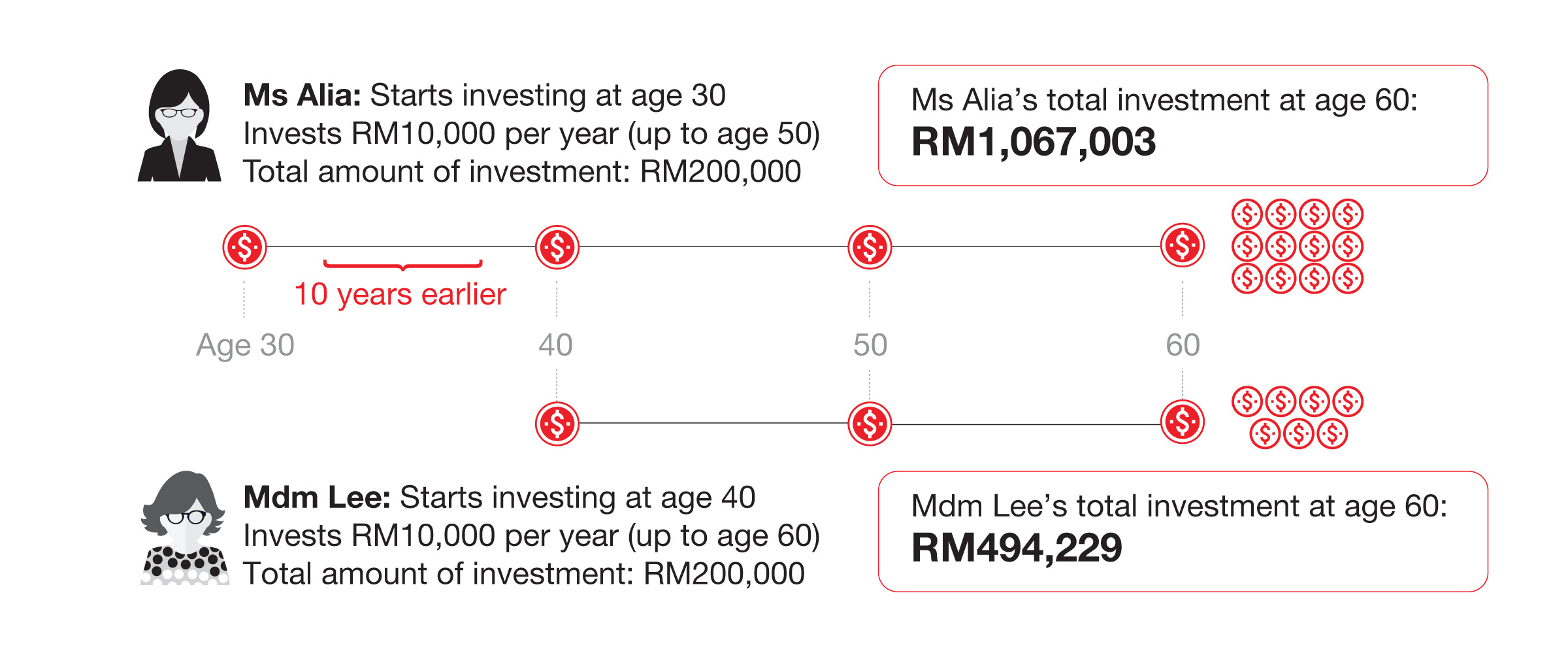

The Benefits of Starting Early

The earlier you start investing, the greater the opportunity to generate higher returns on your original investment.This is due to the effects of compounding.

Name |

Ms Alia |

Mdm Lee |

Starting age |

30 |

40 |

Investment period (years) |

20 |

20 |

Compounding period up to age 60 (years) |

30 |

20 |

Yearly investment (RM) |

10,000 |

10,000 |

Total amount invested (RM) |

200,000 |

200,000 |

Total investment value* at age 60 (RM) |

1,067,003 |

494,229 |

* By starting 10 years earlier, Ms Alia's investment value could grow 116% more than Mdm Lee's investment value when both of them reach the retirement age of 60, assuming that the unit trust's rate of return is constant at 8% per annum. This is only an illustration and does not indicate the past or future performance of any specific unit trust fund.

Download Documents