Private Retirement Scheme

What is Private Retirement Scheme (PRS)?

Private Retirement Scheme (PRS) is a voluntary retirement scheme which enables individuals to contribute based on their retirement needs, investment goals and risk appetite.

Additional Retirement Nest Egg

- Acts as an additional nest egg besides EPF to accumulate sufficient retirement savings

Flexible and Affordable

- Flexible contribution amount according to your affordability

- Initial investment of RM100 and a minimum of RM100 in subsequent contributions

Money in PRS is Protected from Creditors

- Money in PRS is protected from creditors as stated in Section 139ZA of the Capital Markets and Services Act (CMSA)

Tax Incentive

- Allows you to enjoy personal tax relief1 of up to RM3,000

1Including tax relief for deferred annuity.

How Does the Scheme Work?

When you make a contribution, you may choose between:

| Default Option | Non-Default Option | |

| Contributions will be automatically allocated to the core fund that corresponds with the pre-determined age group2 | or | You may select one or more funds from the core or non-core funds regardless of your age |

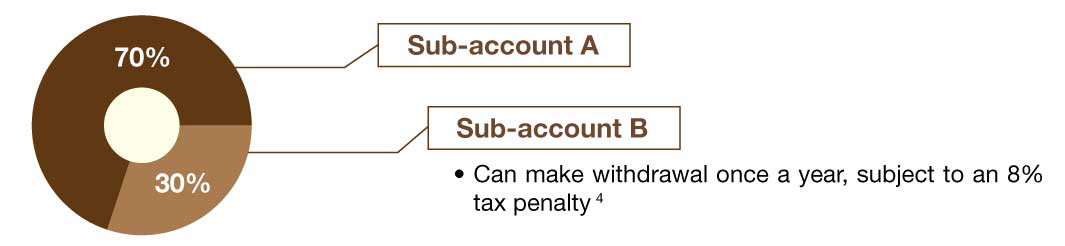

Your contributions will be maintained in two separate sub-accounts:

2 The age group may be subject to change from time to time as determined by the relevant authorities.

3 You are eligible to make a full withdrawal upon reaching the age of 55. Securities Commission Malaysia may specify any other age threshold from time to time.

4 Subject to terms and conditions.

Public Mutual is one of the approved PRS providers. We offer nine PRS funds to suit your needs.

Public Mutual PRS – Conventional Series |

Public Mutual PRS - Shariah-Compliant Series |

Age Group2 |

Public Mutual PRS Growth Fund (PRS-GRF) |

Public Mutual PRS Islamic Growth Fund (PRS-IGRF) |

Age below 45 |

Public Mutual PRS Moderate Fund (PRS-MDF) |

Public Mutual PRS Islamic Moderate Fund (PRS-IMDF) |

Age 45 to below 55 |

Public Mutual PRS Conservative Fund (PRS-CVF) |

Public Mutual PRS Islamic Conservative Fund (PRS-ICVF) |

Age 55 and above |

Public Mutual PRS – Conventional Series |

Public Mutual PRS - Shariah-Compliant Series |

Public Mutual PRS Strategic Equity Fund (PRS-SEQF) |

Public Mutual PRS Islamic Strategic Equity Fund (PRS-ISEQF) |

Public Mutual PRS Equity Fund (PRS-EQF) |

Why Choose Public Mutual?

Enjoy Additional Benefit

• Free Personal Accident insurance coverage5

• Enjoy exclusive privileges and benefits as a Mutual Gold/Mutual Gold Elite/Mutual Platinum member when you accumulate the required Mutual Gold Qualifying Points (MGQPs)

Ease of Transaction

Public Mutual Online (PMO) provides a fast and convenient way to invest, perform transactions and monitor your investment with ease anytime, anywhere

5 For Public Mutual’s PRS contributors only, subject to terms and conditions. Please refer to the brochure on free Personal Accident insurance for more information.

Please refer to the Disclosure Document and the relevant fund’s Product Highlights Sheet for more details of the PRS funds.