Education Planning

Give your children the freedom to pursue their dreams by saving and investing early for their education. By doing so, you can also mitigate the effects of inflation on educationIn recent years, more parents are enrolling their children in private/international schools for both primary and secondary education to enable their children to gain early exposure to the international curriculum before sending them overseas for tertiary education.

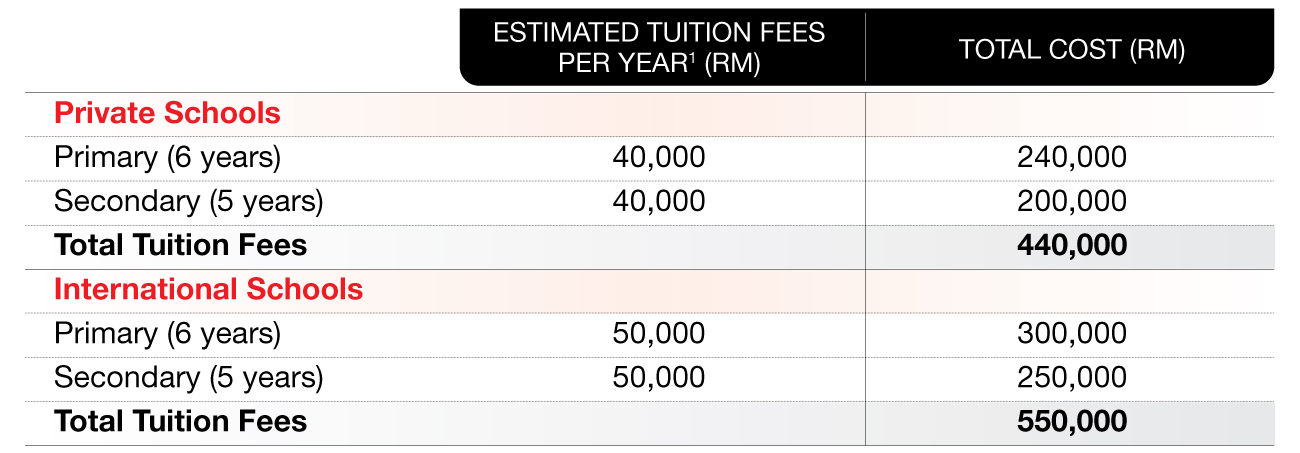

Let’s take a look at the estimated tuition fees1 for private/international schools in Malaysia:

1The estimated tuition fees are computed based on the average fees charged by renowned private/international schools in Klang Valley; exclusive of other costs such as registration fees, deposits, uniforms & books, extra-curricular activities, etc.

Hence, you may need to start investing as early as possible. By investing early, you will be able to capitalise on the power of compounding and be better prepared to support your children in pursuing their dreams.

Proper education planning is essential in ensuring that your child will be able to reach for the stars. However, there are several factors that you should take into consideration before planning for your child’s education.

Number of years before your child attends university

Whether your child will be attending university locally or overseas

Type and length of course

Currency exchange rate of the country of destination

Effects of inflation on your future expenditure

Estimated Tuition Fees & Living Costs by Country

Tuition fees & living costs vary widely from country to country. The table below offers an indication of estimated average annual tuition fees & living costs for international students in selected countries:

| Country | Average Annual Tuition Fees* |

Average Annual Living Costs |

Education Inflation ** |

Australia |

AUD41,280 – AUD52,200 |

AUD30,000 – AUD34,000 |

4.7% |

Canada |

CAD27,101 – CAD70,894 |

CAD15,000 – CAD20,000 |

3.0% |

Malaysia |

MYR15,774 – MYR41,760 |

MYR14,400 – MYR30,000 |

1.9% |

New Zealand |

NZD31,500 – NZD44,078 |

NZD20,000 – NZD25,000 |

2.8% |

Singapore |

SGD33,050 – SGD52,994 |

SGD18,000 – SGD39,600 |

2.7% |

Taiwan |

TWD91,702 – TWD114,960 |

TWD96,000 – TWD144,000 |

2.5% |

United Kingdom |

GBP26,400 – GBP48,620 |

GBP12,180 – GBP15,180 |

4.5% |

USA |

USD55,301 – USD69,324 |

USD10,000 – USD25,000 |

4.0% |

* Non-medical courses

** Education inflation rates shown are based on estimations only.

Source:

Respective universities’ website ^

Excel Education - Top 10 Private Universities to study Business Degree in Malaysia

Shiksha Study Abroad – Cost of Living in Australia for International Students in 2024

Study Destination – Cost of Living in Canada for International Students in 2024

Gyanberry – Average Living Expenses in Malaysia for International Students

AC Schools – Living Costs in New Zealand for International Students

Ngee Ann Academy – Living in Singapore

National Taiwan University – Cost of Living

SI-UK – Student Living Costs in the UK 2024: Guide for International Students

Shiksha Study Abroad – Cost of Living in USA for International Students

Australian Bureau of Statistics

Statistics Canada

Department of Statistics Malaysia

Ministry of Education, New Zealand

SmartWealth Singapore – The Average Education Inflation Rate in Singapore (2024)

Statista – Annual change in the Consumer Price Index (CPI) of Taiwan from 2000 to 2024

Office for National Statistics, UK

Commonfund – 2023 Higher Education Price Index (HEPI) Report

^ Top universities based on QS World University Rankings 2025 By Country

You may consider investing in a country or regional fund that has exposure to the country your children will pursue their tertiary education in. By doing so, you can gain exposure to the currency of the country or region of interest to potentially hedge against foreign currency exchange fluctuations over the long term.

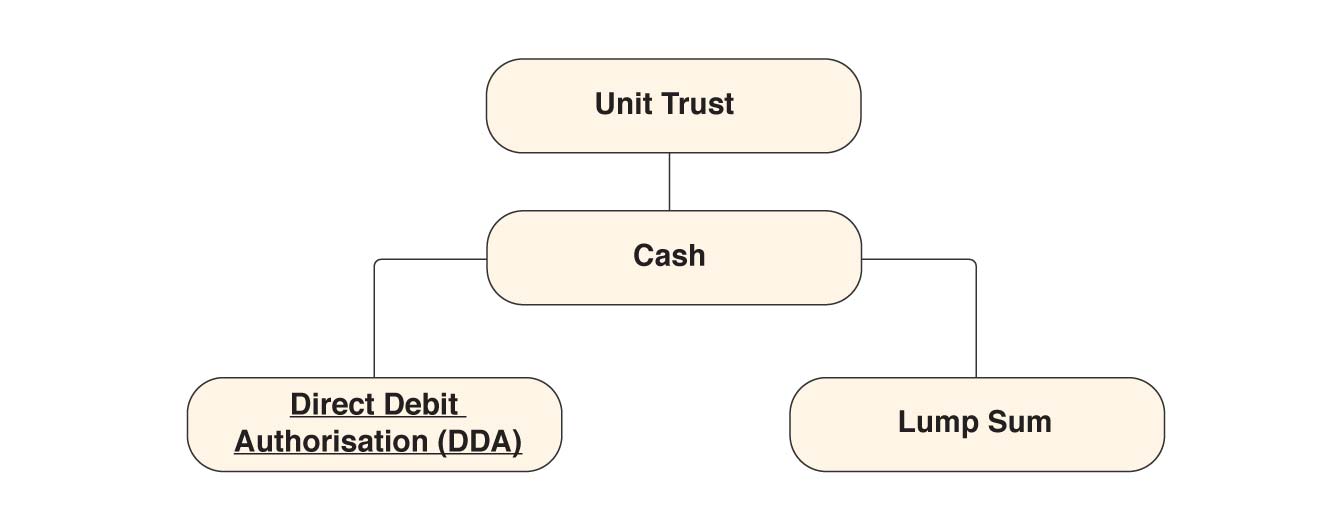

The sooner you begin investing, the higher your chances of providing your children with the future of their dreams. You may consider signing up for the Direct Debit Authorisation (DDA) facility to start investing regularly. If you are a Public Mutual Online (PMO) subscriber, you may enrol for DDA via PMO. Otherwise, you may click here.

In fact, you may also be entitled to free insurance/Takaful coverage by investing in selected unit trust funds offered by Public Mutual.

You should review your target amount, risk tolerance level and rebalance your investment portfolio accordingly.

For example, when the education fund has grown to the amount that is required over the years and wealth preservation is your main concern, you may take a more conservative approach by rebalancing your unit trust portfolio to increase the weightage towards balanced, fixed income or money market funds.