Retirement Planning

With the right retirement plan, you can just sit back and relax during your golden years. Start investing early as the younger you are, the more time you have to grow and accumulate your wealth. Not only that, you can also take advantage of the power of compounding by investing early and regularly.

Proper retirement planning is essential to safeguard your preferred lifestyle during your golden years. For that, you should save and invest your money wisely to ensure you earn a return which is higher than the inflation rate. Here are some common sources of retirement funds:

Employees Provident Fund (EPF)

Private Retirement Scheme (PRS)

Investments – unit trusts, shares

Savings in the bank

Property investments

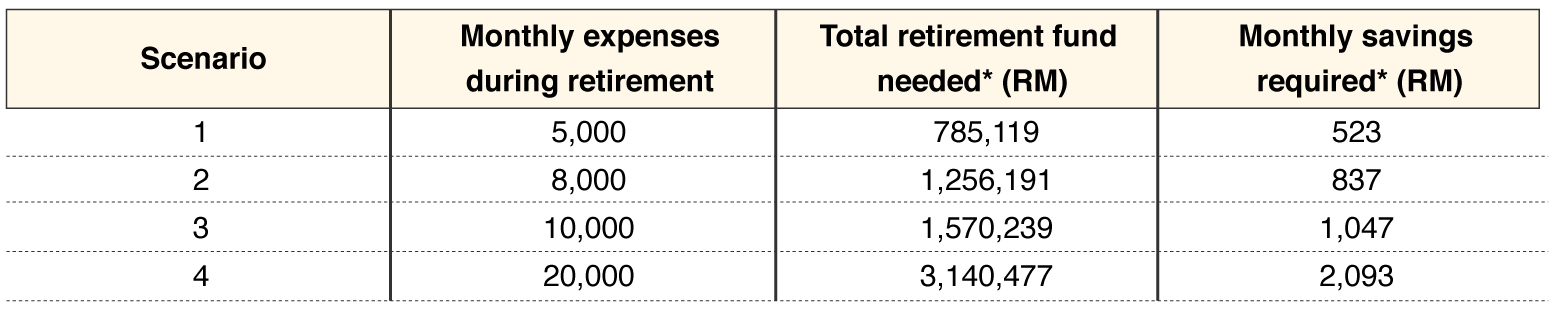

This depends on your monthly expenses during your retirement years*:

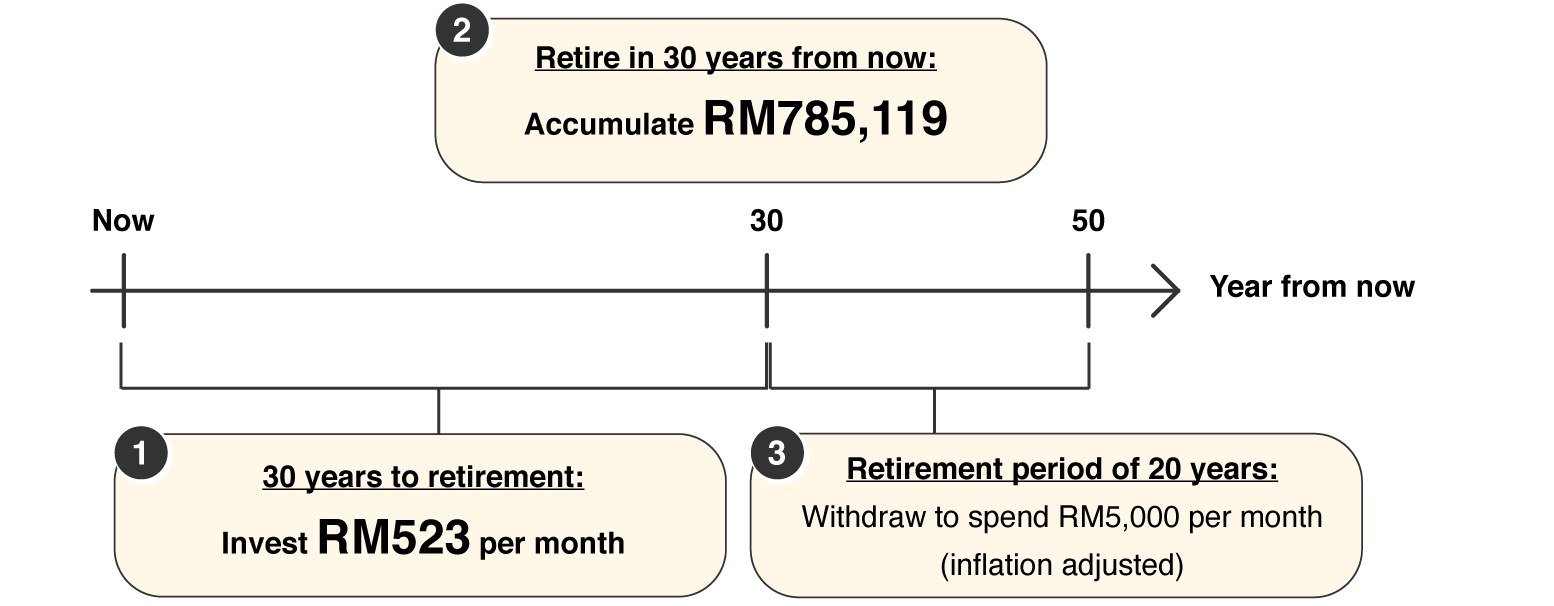

The timeline below illustrates the monthly savings required to meet the target retirement fund for scenario 1 above:

*Assumptions:

i. 30 years to retirement

ii. Retirement period of 20 years

iii. Rate of Return is 8% and inflation is 3%

iv. Retirement expenses are withdrawn annually at the beginning of the year

There are several ways in which you can boost your retirement savings.

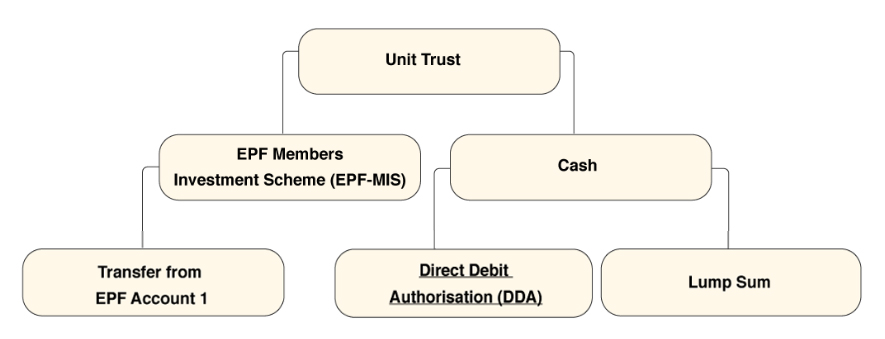

A unit trust is an investment vehicle with the potential to help you accumulate wealth or build your retirement fund. It is easy, convenient and affordable. To that extent, Public Mutual offers a wide range of conventional and Shariah-compliant unit trust funds for you to choose from.

Optimise Your Retirement Savings via the Employees Provident Fund-Members Investment Scheme (EPF-MIS)

You can choose to diversify your retirement portfolio and enhance your retirement savings through EPF’s Members Investment Scheme. Under the EPF-MIS, you can transfer part of your funds in your EPF Account 1 for investments with Public Mutual.

Here’s how investing in the EPF-MIS can help you maximise your retirement savings.

No cash required,

you can transfer

directly from

EPF Account 1

Opportunity to

diversify into global,

regional and

domestic funds

A wide range

of EPF-qualified

unit trust funds

that you can

choose from

Complimentary

Insurance/Takaful coverage

for selected funds

On top of that, you can also tap into the growth potential of our EPF-qualified funds.

Supplement your retirement savings via PRS

Private Retirement Scheme (PRS) is a voluntary long-term contribution scheme designed to accumulate savings for retirement that complements the mandatory contribution made to EPF. Here are some of the benefits that you get to enjoy when you contribute to PRS.

Personal tax relief

of up to RM3,000

(including tax relief

for deferred annuity)

Money in PRS

is protected

from creditors^

Free

Personal Accident Insurance/Takaful

coverage^^

Flexibility

in choosing the fund(s),

contribution amount

and interval*

^ Money in PRS scheme is protected from creditors as stated in Section 139ZA of the Capital Markets and Services Act (CMSA).

^^ For Public Mutual PRS contributors only, subject to terms and conditions. Please refer to the Insurance/Takaful page for more information.

* The age group may be subject to changes as may be determined by the relevant authorities from time to time.

It is advisable to have the following insurance coverage for a worry-free retirement:

Term Life

Hospitalisation & Surgical

Critical Illness

Personal Accident

Planning ahead is always the best way to protect yourself against any possible financial strain. Public Mutual offers complimentary Term Life and Personal Accident Insurance/ Takaful coverage for its unitholders under selected unit trust funds. Besides that, there are also other optional insurance that may suit your needs.

For more information on this, please click here.

** Subject to terms and conditions.

Estate planning is an important component in the financial planning process. Proper estate planning will ensure a smooth distribution of your assets to your loved ones according to your wishes. Hence, you should look into estate planning.

| Will/ Wasiat Writing A will is a legal document that clearly states your wishes for the distribution of all your assets upon your demise. Wasiat, on the other hand, is for Muslim unitholders to distribute their assets to Faraid and non-Faraid beneficiaries, if any. |

Meanwhile, you can also opt to add a joint holder to your single name unit trust account to smoothen the transfer of your investments when the need arises.

There’s something for everyone at Public Mutual as the Company promotes various categories of funds, namely equity fund, mixed asset fund, balanced fund, bond/fixed income fund and money market fund, which cover different sectors, industries, and regions. There are more than 160 unit trust funds and 9 PRS funds that you can pick and choose according to your risk appetite.

Enjoy much more for your retirement!

As you save and invest for your retirement, you will be entitled to exclusive privileges when you invest with us and become our Privilege Circle Members.

Click here to view the Privilege Circle membership benefits and privileges.

Your investment in our unit trust and PRS funds will be granted Mutual Gold Qualifying Points (MGQP) where you will be offered with privileges under the respective categories once you have accumulated the required amount of MGQP.

Want to know more on how you can accumulate MGQP? Know more.

Investors are advised to read and understand the contents of the relevant Prospectuses, Supplemental Prospectuses, Disclosure Documents and Product Highlights Sheet (PHS) before investing. Investors should understand the risks of the fund(s), compare and consider the fees, charges and costs involved in investing in the fund(s). A copy of the Prospectus, Supplemental Prospectus and PHS can be viewed at our website. Investors should make their own assessment of the merits and risks of the investment. If in doubt, investors should seek professional advice. Please refer to our website for our investment disclaimer.